Note: This essay was written in August 2011 and relates to the economics of the time. Later figures are stated with the time (mostly 2018). Obama couldn’t solve the incredible economic downslide of the United States, in 2018 Trump is making it worse with his lunatic policies and direct scuffle with the trading partners of the United States.

August 03, 2011: Everybody please stand up and clap. The world can rejoice and go back to its old ways. The United States economic crisis has been solved.

The Country that owes the world 14.39 trillion dollars (that is 14,390 billion dollars) has now decided that it could borrow another 2.41 trillion (2,410 billion) dollars and spend them by 2013. Its credit rating of AAA will remain intact; tax cuts introduced by George Bush and meant to be rescinded in 2010 can go on regardless. Out of the 14.39 Trillion debt (till August 1), over 11 Tn were incurred during the post-cold war era; George Bush’s war on terror (read war on two men) spent 6 Tn of other peoples’ money.

In the meanwhile, America’s debt burden has already (in 2011) crossed the Annual Gross Domestic Product of the Country by some 10 to 15%. Americans, seemingly charitable and helpful (particularly to dictators and terrorist havens), were actually having a great time at the expense of money borrowed from poorer nations at a poor rate of interest. (‘AAA’ rating). The problem is – even low rates of interests become huge rates, effectively cumulative interest rates, when you start borrowing to pay interest.

President Obama is a passive onlooker while the Republican-dominated and pro-tax-cut US Congress voted for this ‘solution’. Like him, his Democratic party has no option but to swim with the current. The other option is not being able to pay Government bills and salaries, or having to pay much higher rate of interest (‘D’ rating) on the present debt which (the interest) stands at more than a third of a trillion as it is. The additional debt will go to pay the interest , and by 2012, when Obama’s second term (if it Happens – and if the much harried dreamer even chooses to run for the next term), the cumulative effect of this interest-to-pay-interest policy will bite off the chunk of America’s annual budget – more than defence spending, health insurance (Obama’s pet project and the rich man’s demon) and pension and education (the other pet project).

Where would all this debt-money come from?

- Treasury bills and bonds. Some collected domestically, the rest from China, Japan, South Korea and so on. (If India has any share in it, it is insignificant. But we are catching up – India has pledged 2 Bn dollars – trifle more than what has been pledged to our poorer neighbours like Bangladesh and Afghanistan – to finance European bailout).

- Banks in Belgium, Switzerland etc which won’t disclose their sources. In other words, money deposited by, among others, our own unscrupulous politicians, mafia and hawala operators.

If you in India have any hope that those black dollars can be brought back home, forget about it. Ramdev did right giving up his fast-unto-death threat (Click the image below)..

The United States has been a heavy borrower since the world war. In 1980, the debt figure stood at about 800 Billion dollars, about 50% of the GDP. Till the year 2000, debt grew in the same proportion with GDP – in other words, the growth in national product was a constant function of the loan taken by the Government.

Then came the most profligate President of the United States – George W. Bush Jr. Even before 9/11, the GDP growth fell from 3.8% to a negative 0. 6%; unemployment steadily grew. Bush, like a prodigal prince, seems to have thought that the treasury was his ancestral property. Tax cut for the rich was his pet scheme which was pushed forward with great urgency. If you watch the chart published by the Bureau of Economic Analysis and the Bureau of Labour Statistics, you would see that the tragedy of 9/11 came as a windfall for George Bush. This Court-appointed President of the United states won a second term in a genuine election while he plunged the country into expensive and tragic wars. Debt ceiling was revised progressively year after year, the debt chart rose like the tower of Burj Khalifa right from Bush’s Presidency as never before. Look at the chart:

Cost of Iraq war exceeded 3 trillion; the cost of it in Afghanistan is probably not much less when all the body bags have gone home. Compensation for the Loss of thousands of troops in both theatres, cost of care and rehabilitation of those thousands who came home injured physically and mentally and the overhead and logistic costs have not probably been computed. The cost of lives and property lost by native Afghans and Iraqis, of course, do not count. These wars would only encourage the terrorists to prepare to strike again; what has prevented them so far is an increase in vigilance and homeland security. In other words, those five or six trillion spent was not for improving security of US citizens, but for wreaking revenge on two men – Osama Bin Laden and Saddam Hussein. The latter was not even an international terrorist; he simply terrorized the Kurds and his close neighbours.

The cost of war has hardly abated. Obama has not been able to come out of it. Not even his writing and oratory skills and ability to dream big can help the United States dismount the tiger. In other words, by 2013, when every US citizen, young and old, employed or unemployed, will owe over 75,000 dollars to every human being on earth, there will be another need for mapping a sharp rise in the debt ceiling. As it is, the interest paid out per year is more than 350 Billion; by 2013, it could exceed half a Trillion. It is predicted by CNN that interest payable by the United States per year in 2028 could be as much as 1.05 Trillion.

Republicans want huge cost cuts to ease the debt burden. What they target is Obama’s pet project of health insurance for all (repeal the Act?) and Government spending which means sacking of employees. Big business would also want stimulus packages which they can distribute as bonus among top management. What they do not want is a repeal of tax cuts for the rich.

Does it really matter? Everyone knows that the United States will never get out of the debt trap. There is little difference between drowning in ten feet deep water or ten thousand feet deep. There is one difference in the case of a country like United States though – the deeper it sinks, it would carry more countries with it.

Compare China’s performance with that of the US. Its GDP in 2011 was (which nearly tripled to 14 billion in 2018) to the tune of 5.9 trillion (growing 10% annually), slightly more than a third of United States’. Its external debt stands at a trifle 406 billion – one-fortieth of US debt. A Chinese citizen would owe 303 dollars of debt, while at about 3 trillion investments abroad, the same world (which means the United States, mostly) would owe him or her 2,000 dollars.

India, once notorious for her begging-bowl image is behind China, but fares far better than the US and the “rich and developed” European Countries which might sink with the US sooner or later. First world stands first in debt. An Indian owes less than US$ 200 external debt which rests at a mere 237 Billion as against a GDP of 1.54 trillion. Her average annual GDP growth rate is at or around 8% while that of the US is 1 to 1.5%. Despite its huge population , (3.4 times that of the US) and smaller land area and weaker industrial infrastructure, India’s unemployment rate is nearly the same as that of the US. My figures are approximate, but they give you the general picture.

While I got down to brush up this blog before putting it up on site, my Australian friend Llew Fernandez sent me these startling statements:

- China has 19% of the world’s population, but consumes… 53% of the world’s cement… 48% of the world’s iron ore… 47% of the world’s coal… and the majority of just about every major commodity.In 2010, China produced 11 times more steel than the United States.

- New World Record: China made and sold 18 million vehicles in 2010

- There are more pigs in China than in the next 43 pork producing nations combined. (Who said Pigs aren’t economic units? Ask the guy who brings home the bacon).

- China currently has the world’s fastest train and the world’s largest high-speed rail network.

- China is currently the number one producer in the world of wind and solar power.

- China currently controls more than 90% of the total global supply of rare earth elements.

- In the past 15 years, China has moved from 14th place to 2nd place in the world in published scientific research articles.

- China now possesses the fastest supercomputer on the entire globe.

- At the end of March 2011, China accumulated US$3.04 trillion in foreign currency reserves – the largest stockpile on the entire globe.

- While they manufacture 80% of the world’s solar panels, They install less than 5%. And,

- a new coal fired power station every week and in 1 year turn on more new coal powered electricity than Australia’s total output

- China is developing the most ingenious aircraft carrier till date – it is an airport straddling two ships, catamaran style.

I do not know the source of Llew’s data; but they do look reasonably reliable. More importantly, despite its huge military clout, China has not initiated an attack any country since the cultural revolution. Most of its huge success s rests on that fact alone.

Don’t forget the side show. European countries are bursting their balloons. Greece , Ireland, Portugal, Spain, Italy. EU – meaning Germany and France, mostly – and some non-European Countries might chip in to bail them out while their citizens would resist any effect on the Khushi time they have had. It won’t be easy to bail out rich man Sylio Berlusconi’s Italy. When The party is over. do you think the ‘rich’ European Union will disintegrate simply under the weight of deficit financing?

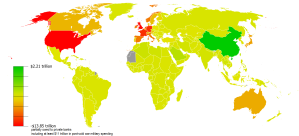

Take a look at the alarming state of affairs – Foreign debt vs foreign exchange reserves of the ‘First World’ nations:

(For enlarged details, click the map)

Red shows countries that have negative results; United States is at the bottom of the pit with -13.85 Tn. Even Australia is not far behind the other “First World” nations.)

If you ask me, India should learn where to nurture acquaintance and whom to make friends with. As of now, we have got it all wrong. Mr. Foreign Secretary, please make a visit to Peking and don’t forget to wear your best smile.

This man Vishu Menon, should have a say in running the affairs of the country.His Blog makes good reading & shows a lot of common sense, a commodity which isnt very common these days !

LikeLike

Perhaps, Llew Fernandez, the Chinese have also read my blog. (sorry, bad joke). They have today issued a stern warning to the US: Wake up or pack up. We have the right to warn you, they said, because you are playing with our money. They also told the world to think of another currency than US Dollars for international trading.

I do hope it’s not a case of ‘Pride goes before the fall’ for the US. Don’t we all have a stake in the United States in some form or another? And where will China export all its shoddy goods if US packs up?.

LikeLike

Llew, haven’t you heard that good critics make bad administrators?

But thanks for the comment. This was one I was so happy and excited to approve.As I have indicated in the text, your mail inspired the blog.

BTW, America’s AAA rating is now down to AA (S&P) and AA+. Do you think they read my blog? (just joking).

I invite you to read also “Science that works and Religion that doesn’t”, the previous blog. An old classmate stopped writing to me because of another blog. A friend like you is far more trustworthy. Thanks again.

LikeLike

I am actually grateful to the holder of this web

page who has shared this enormous piece

of writing at at this time.

LikeLike

I’m truly enjoying the design and layout of your site. It’s a very easy on the eyes which makes it much more

pleasant for me to come here and visit more often. Did you hire out a designer to create your

theme? Excellent work!

LikeLike